< HOME > last reviewed: 12-22-2018

THE USA Universal Health CARE System ( as envisioned by a citizen & voter - Susan)

“A long habit of not thinking a thing wrong, gives it a superficial appearance of being right, and raises at first a formidable outcry in defense of custom.

But the tumult soon subsides. Time makes more converts than reason.” Thomas Paine

And, so it goes with American Health Care - and, the CURRENT practice of American Health Care INSURANCE. [ which we will change ]

- Please, send me a message - by using my form. < CONTACT >

Susan's current research follows. Please feel FREE - to use my HYPERLINKED research - below (to make your own document).

I can only hope you use this information - to HELP support HR676 - and, the good efforts of the DEMOCRATS & some REPUBLICANS

to finally make America a great country (again). Good LUCK! Please let me know - if I can HELP you. - Susan - - Please, send me a message - by using my form. < CONTACT >

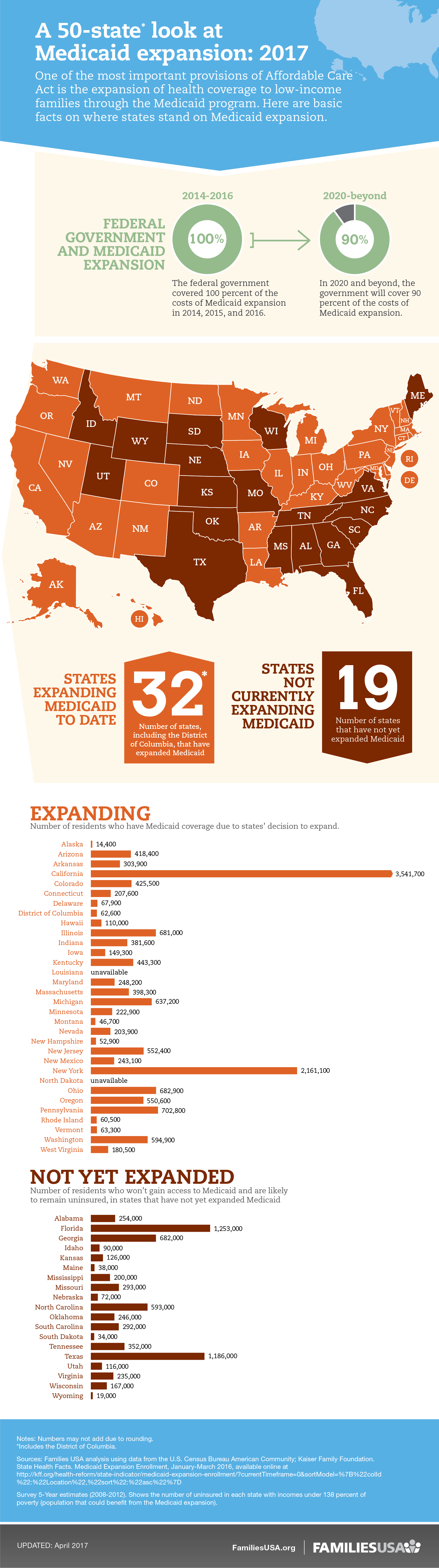

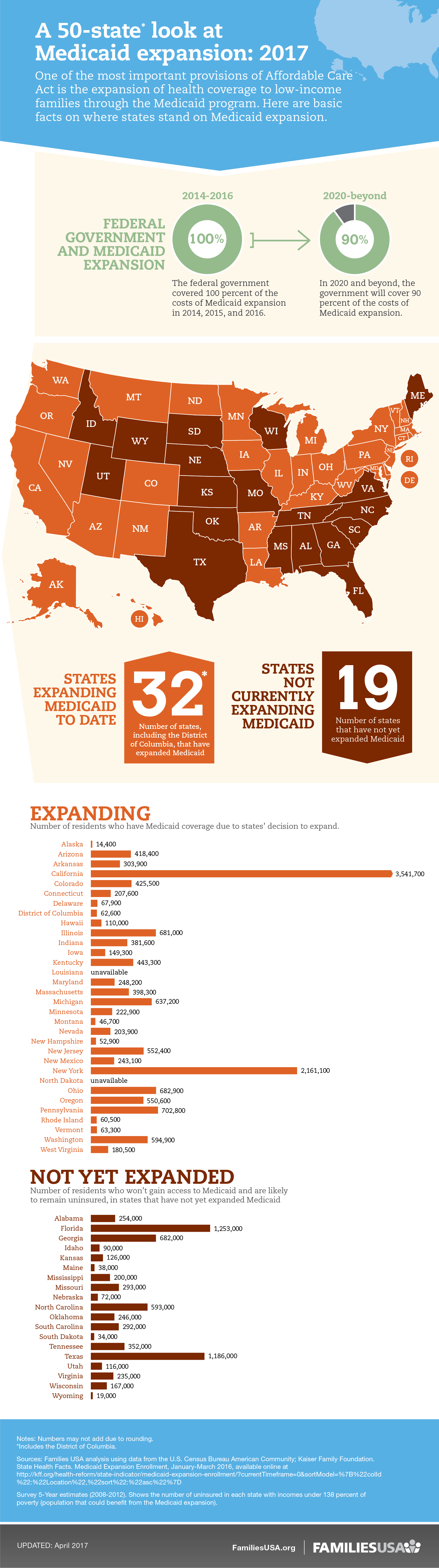

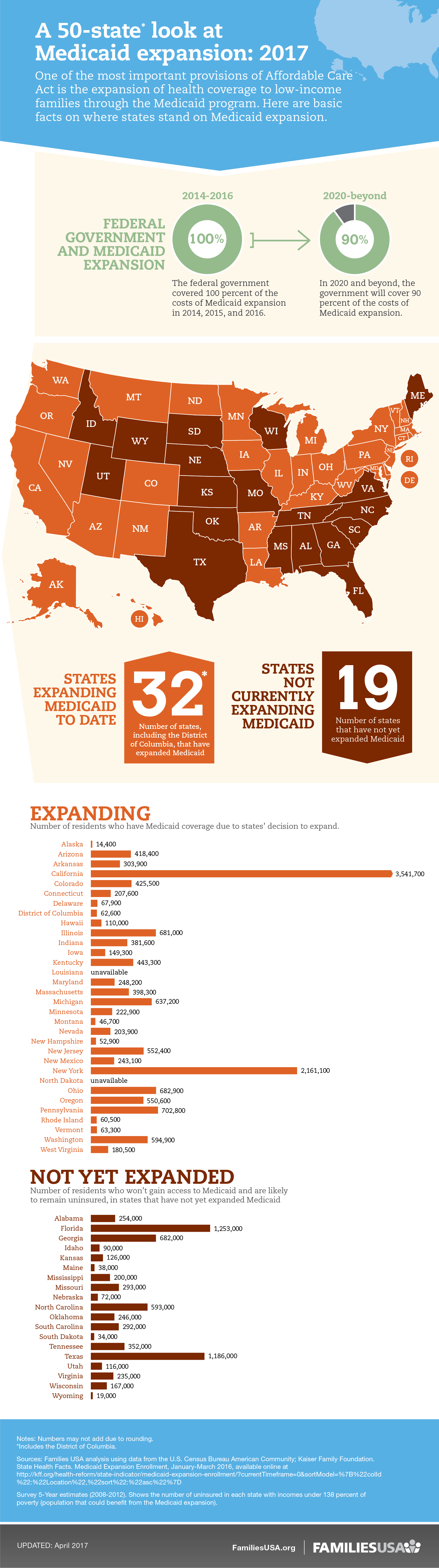

(From the DEMOCRAT'S nATIONAL pLATFORM DOCUMENT ( THE 2016 DEMOCRATIC PLATFORM: https://www.democrats.org ) " Securing Universal Health Care : Democrats believe that health care is a right, not a privilege, and our health care system should put people before profits. Thanks to the hard work of President Obama and Democrats in Congress, we took a critically important step toward the goal of universal health care by passing the Affordable Care Act, which has covered 20 million more Americans and ensured millions more will never be denied coverage because of a pre-existing condition. Democrats will never falter in our generations-long fight to guarantee health care as a fundamental right for every American. As part of that guarantee, Americans should be able to access public coverage through a public option, and those over 55 should be able to opt in to Medicare. Democrats will fight any attempts by Republicans in Congress to privatize, voucherize, or “phase out” Medicare as we know it. We will keep fighting until the ACA’s Medicaid expansion has been adopted in every state. Nineteen states have not yet expanded Medicaid. This means that millions of low-income Americans still lack health insurance and are not getting the care they need. Additionally, health care providers, clinics, hospitals, and taxpayers are footing a higher bill when people without insurance visit expensive emergency rooms.

Supporting Community Health Centers: We must renew and expand our commitment to Community Health Centers, as well as community mental health centers and family planning centers. These health centers provide critically important, community-based prevention and treatment in underserved communities, prevent unnecessary and expensive trips to emergency rooms, and are essential to the successful implementation of the ACA. We will fight for a comprehensive system of primary health care, including dental, mental health care, and low-cost prescription drugs by doubling of funding for federally qualified community health centers over the next decade, which currently serve 25 million people. Democrats also know that one of the key ingredients to the success of these health centers is a well-supported and qualified workforce in community-based settings. We will fight to train and support this workforce, encourage providers to work with underserved populations through the National Health Service Corps, and create a comprehensive strategy to increase the pool of primary health care professionals. Democrats are committed to investing in the research, development, and innovation that creates lifesaving drugs and lowers overall health costs, but the profiteering of pharmaceutical companies is simply unacceptable. " [ It is important to know this. However, Susan should not be "preachin' to the choir". ] https://www.democrats.org

Senario 1 ( If needed, other scenario illustration examples will be constructed.) - Please, send me a message - by using my form.

|

SCENARIO assumptions: |

( Fred and his wife ) |

|

1) Fred is a 61-year-old male.

2) Fred is a United States citizen.

3) Fred has worked - in the united States [as a "maintenance worker" ] for a "big corporation" -since he was 16-years old. Each year he has paid his personal income taxes due.

4) Fred is married - and, has been for 36+ years - and, he has two grown children. They live in California & Oregon.

5) Fred owns a modest home - in Columbus, Ohio.

6) Fred has a small sum (of cash) saved in the bank.

7) Fred & his wife have planned:

a] to sell their "paid for" home

and b] take a small vacation - after he retires.

8) Fred's wife never did (really) work outside of their home.

9) If they see a place - perhaps a condo - on their planned vacation, they may consider buying it.

10) Fred's wife's health is "good". She wants to "lose a few pounds" - she says. She goes to the YMCA - most days. She walks on the treadmill and does the "zoomba class" sometimes. She cooks breakfast, lunch & dinner - for Fred & herself - most days. She sleeps well. And, Fred finds her usually pleasant to be around.

11) Fred's health is "good" - to outward appearances; however, Fred has noticed some "shortness of breath" - when he exerts himself; and, he gets "sweaty" - unexpectedly - at times. His sleep is disturbed - some nights - by "nightmares".

12) Fred has said nothing about his "small personal issues" to his wife. (He does not want to "worry" her.)

13) Fred has "health insurance" supplied by his employer.

14) Fred wants to take the "early retirement" option - his employer has just offered him.

|

( WE ARE ALL AMERICANS ! )

|

|

|

|

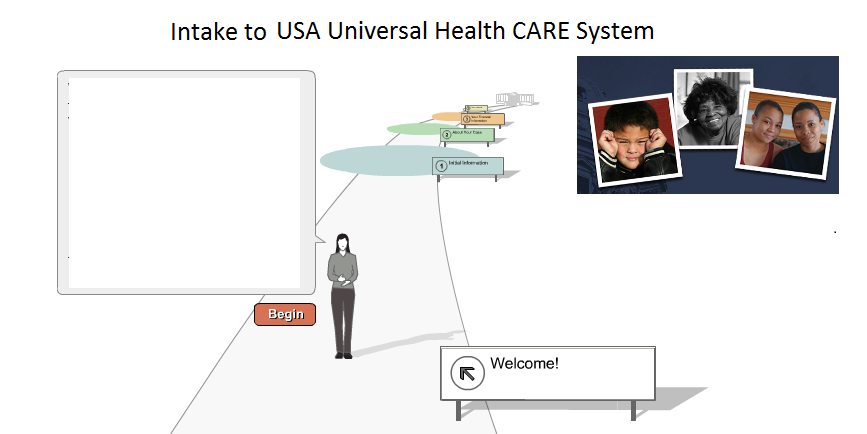

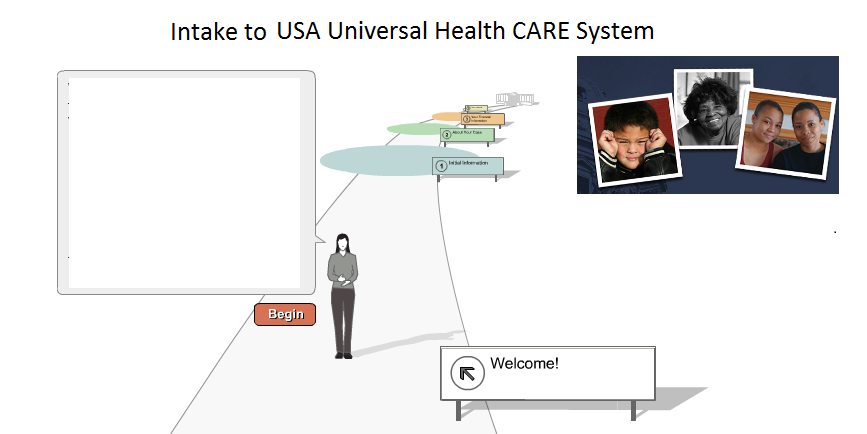

( INTAKE Centers - all over the USA ) Hello! How may I help you today? You can: 1) fill out a form; 2) Talk to a computerized assistant; 3) Make an appointment - to talk with a human USA Universal Health Care "intake" professional; or, 4) Please just leave your name - and, a method & we will you.

You came in the door for "something". Let's get to it.

hhh  < Americans >

< Americans >

FlowChart (start) Fred has made the "first STEP" - "intake" (above) NOTE: Graphic (above) - from USA Legal Aid Society

[ DECISION POINT ] : Is "Fred's Issue" an EMERGENCY ? YES-GO A NO-GO B UNKNOWN-GO C

A ( EMERGENCY - YES )

B ( EMERGENCY - NO )

C ( EMERGENCY - UNKNOWN )

Hhhhhhhhhhhhhhhh Kaiser Chart hhhhhhhhhhhhhhhhhh

http://www.kff.org/other/state-indicator/total-population/?currentTimeframe=0&sortModel=%7B%22colId%22:%22Location%22,%22sort%22:%22asc%22%7D

Health Insurance Coverage of the Total Population

NOTES ( by Kaiser)

The majority of our health coverage topics are based on analysis of the Census Bureau’s March Supplement to the Current Population Survey (the CPS Annual Social and Economic Supplement or ASEC) by the Kaiser Commission on Medicaid and the Uninsured. The CPS supplement is the primary source of annual health insurance coverage information in the United States.

In this analysis, income (mostly categorized as a percent of the federal poverty level) is aggregated by Census-defined family units. Analyzing income by family unit captures income available to a group of people who are likely sharing resources. However, family units may not be the appropriate measure for capturing eligibility for health insurance. Eligibility for health insurance is more accurately estimated using “health insurance units,” which may be counted differently for different types of insurance (such as Medicaid or employer coverage).

Data exclude a small number of people with private coverage of an unknown source. Data may not sum to totals due to rounding and the exclusion of these people.

Sources

Kaiser Family Foundation estimates based on the Census Bureau's March 2014, March 2015, and March 2016 Current Population Survey (CPS: Annual Social and Economic Supplements).

Definitions

The ASEC asks respondents about their health insurance coverage throughout the previous calendar year. Respondents may report having more than one type of coverage. In this analysis, individuals are sorted into only one category of insurance coverage using the following hierarchy:

Medicaid: Includes those covered by Medicaid, the Children’s Health Insurance Program (CHIP), and those who have both Medicaid and another type of coverage, such as dual eligibles who are also covered by Medicare.

Medicare: Includes those covered by Medicare, Medicare Advantage, and those who have Medicare and another type of non-Medicaid coverage where Medicare is the primary payer. Excludes those with Medicare Part A coverage only and those covered by Medicare and Medicaid (dual eligibles).

Employer: Includes those covered by employer-sponsored coverage either through their own job or as a dependent in the same household.

Other Public: Includes those covered under the military or Veterans Administration.

Non-Group: Includes individuals and families that purchased or are covered as a dependent by non-group insurance.

Uninsured: Includes those without health insurance and those who have coverage under the Indian Health Service only.

For example, a person having Medicaid coverage in the first half of the year but employer-based coverage in the last months of the year would be categorized as having Medicaid coverage in this analysis.

N/A: Estimates with relative standard errors greater than 30% are not provided.

TAGS

CATEGORIES

Business owners wouldn’t have to insure their workers.

Obamacare required businesses with at least 50 full-time employees to provide its workers with “affordable” insurance – essentially, insurance that cost less than 10 percent of a worker’s household income. Failure to do that currently costs business owners up to $2,260 per employee annually. That tax penalty would disappear under the GOP plan.

So if a person owned a medium-sized business, and didn’t want to provide insurance, she or he could stop.

Here’s the thing: This penalty didn’t affect most “small business” owners.

Of the nearly 30 million businesses in the U.S., 80 percent have no employees – the proprietor is the only one in the shop, according to Small Business Administration data from 2013.

Many medium-sized businesses already provided insurance for their workers before Obamacare took effect. So while some may be glad that they can stop, others are wondering how the GOP health plan will affect insurance rates. Will they be able to afford their employees’ insurance?

Currently, 52 percent of Ohioans get their insurance through an employer, compared with only 5 percent who get private insurance on the Obamacare exchange, according to Kaiser data.

http://www.cincinnati.com/story/news/politics/2017/03/11/5-ways-house-gop-health-plan-would-affect-ohioans/98987230/ <source

http://www.kff.org/other/state-indicator/total-population/?currentTimeframe=0&sortModel=%7B%22colId%22:%22Location%22,%22sort%22:%22asc%22%7D

|

|

|

|

|

|

|

|

|

|

Health Insurance |

Insurance Coverage |

Insurance Premium |

Expense |

Adjusted Gross Income - AGI |

Deductible |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

HEALTH-CARE PROFITEERING profit sick people illness < Googled

https://www.forbes.com/sites/peterubel/2014/02/12/is-the-profit-motive-ruining-american-healthcare/#315aad4637b9

http://www.vanityfair.com/news/2009/09/health-care200909

Health Insurance Copied ‘originally FROM: http://www.investopedia.com/terms/h/healthinsurance.asp?lgl=myfinance-layout-no-ads Date of copy: 6-27-2017

By Investopedia Staff ( Susan is preparing a PDF document - that will list "Investopedia Staff" [ the human beings ] by name ) The following has been edited - by Susan.

What is 'Health Insurance'

Health insurance is a type of insurance coverage that pays for medical and surgical expenses incurred by the insured. Health insurance can:

- reimburse the insured for expenses incurred from illness or injury, or

2) pay the care provider directly.

It is often included in employer benefit packages as a means of enticing or retaining quality employees.

The cost of health insurance premiums is deductible to the payer, and benefits received are tax-free.

(As seen above "Health insurance" companies make "billions" of dollars - each year - for their investor "Owners".)

Thus, Susan ask: Why do we need insurance companies - at all? )

BREAKING DOWN 'Health Insurance'

THERE ARE DIFFERENT TYPE OF “HEALTH INSURANCE” PROGRAMS:

Managed care insurance plans (MCIP) - are ONE of the types.

A] MCIP require policy holders to receive care from a network of designated health care providers for the highest level of coverage.

B] If patients seek care outside the MCIP network, they must pay a higher percentage of the cost.

C] In some cases, the MCIP may refuse payment outright for services “obtained out of network”. Many MCIPs require patients to choose a “ primary care physician “ who oversees the patient's care and makes recommendations about treatment.

D) MCIP Insurance companies may also deny coverage for services that were obtained without pre - authorization.

E) In addition, MCIP insurers may refuse payment for name brand drugs if a generic version or comparable medication is available at a lower cost.

MCIPs (with higher out-of-pocket costs) generally have smaller monthly premiums than plans with low deductibles.

Affordable Care Act

In 2010, President Barack Obama signed the “Patient Protection and Affordable Care Act “ into law.

The ACA prohibits insurance companies from:

1) denying coverage to patients with pre-existing conditions,

2) and allows children to remain on their parents' insurance plan until they reach the age of 26.

3) In participating states, the act also expanded Medicaid, a government program that provides medical care for individuals with very low incomes.

4) In addition to these changes, the ACA established the “federal Healthcare Marketplace”. The “marketplace” helps individuals and businesses shop for quality insurance plans at affordable rates. Low-income individuals who sign up for insurance through the marketplace may qualify for subsidies to help bring down costs.

Under ACA Americans are required to carry medical insurance ( that meets “federally designated minimum standards” ) or face a tax penalty.

In certain cases, taxpayers may qualify for an exemption from the penalty - if they were unable to obtain insurance due to financial hardship or other situations.

[ END of copy ]

MORE RESEARCH

Sent: 6-27-2017

"Hello. I am preparing a document - for posting to my personal web site ( https://hansandcassady.org/ ). The topic is: WHY do we need Medical Insurance Companies ( at all )?

I am a supporter of Congressman John Conyer's Bill HR676. I currently believe that HR676 can be improved - by eliminating Health Care - Insurance companies - alltogether.

I believe that Americans should pay into a central system [instead] - such as Social Security - and, the funds collected would be used to fund USA Universal Health Care.

Thus, eliminating - the "middle-man" of insurance companies. I do NOT wish to harm your good efforts.

I remain an "Obama Girl" at this writing. Please suggest any reading material - to me ( by email)- that you feel may be helpful - or, informative to me."

https://questions.cms.gov/newrequest.php

history Medical Insurance

https://www.cms.gov/About-CMS/About-CMS.html

https://marketplace.cms.gov/ < official Marketplace

https://www.healthcaremarketplace.com/

https://www.healthcaremarketplace.com/about_us?on=L1auZSXy_pcrid_organic-HCMP-

http://pnhp.org/blog/2016/11/28/our-profiteering-health-insurance-industry-should-the-government-bail-it-out-again/

https://www.forbes.com/sites/peterubel/2014/02/12/is-the-profit-motive-ruining-american-healthcare/#315aad4637b9

HEALTH-CARE PROFITEERING < Google

http://www.vanityfair.com/news/2009/09/health-care200909

profit sick people illness < Googled

https://en.wikipedia.org/wiki/Health_insurance_in_the_United_States#History :: During the 1920s, individual hospitals began offering services to individuals on a pre-paid basis, eventually leading to the development of Blue Cross organizations in the 1930s. The first employer-sponsored hospitalization plan was created by teachers in Dallas, Texas in 1929.

https://en.wikipedia.org/wiki/Health_insurance_in_the_United_States

“ communal interests “ “risk sharing” Health Care < Googled

https://www.help.senate.gov/imo/media/Risk_Sharing.pdf

Ely Times column: Individual rights vs. communal interests

Insurance Coverage

What is 'Insurance Coverage'

Insurance coverage is the amount of risk or liability that is covered for an individual or entity by way of insurance services.

Insurance coverage, such as auto insurance, life insurance – or more exotic forms, such as hole-in-one insurance – is issued by an insurer in the event of unforeseen occurrences.

BREAKING DOWN 'Insurance Coverage'

Insurance coverage helps consumers recover financially from unexpected events, such as car accidents or the loss of an income-producing adult supporting a family.

Insurance coverage COST is often determined by multiple factors. In Medical Insurance, the factors are: X, Y, Z

Insurance Premium

By Brent Radcliffe www.investopedia.com/contributors/242/

What is 'Insurance Premium'

An insurance premium is the amount of money that an individual or business must pay for an insurance policy. The insurance premium is considered income by the insurance company once it is earned, and also represents a liability in that the insurer must provide coverage for claims being made against the policy.

BREAKING DOWN 'Insurance Premium'

The amount of insurance premium that is required for insurance coverage depends on a variety of factors. Insurance companies examine

the type of coverage,

the likelihood of a claim being made,

the area where the policyholder lives or operates a business,

the behavior of the person or business being covered,

and the amount of competition that the insurer faces.

[[ https://en.wikipedia.org/wiki/Actuary ]] < Good INSURANCE History section - BASICALLY, WHY we have insurance - the concept.

Actuaries employed by an insurance company can determine, for example, the likelihood of a claim being made against a teenage driver living in an urban area compared to one in a suburban area. In general, the greater the risk associated with a policy the more expensive the insurance policy will be.

Policyholders are often given a number of options when it comes to paying an insurance premium. Some insurers allow the policyholder to pay the insurance premium in installments, for example monthly or semi-annual payments, or may require the policyholder to pay the total amount before coverage starts.

Insurance premiums may increase after the policy period ends. The insurer may increase the premium if claims were made during the previous period, if the risk associated with offering a particular type of insurance increases, or if the cost of providing coverage increases.

Insurers use the insurance premium to cover the liabilities associated with the policies that they underwrite, as well as to invest the premium in order to generate higher returns. Insurers will invest the premiums in assets with varying levels of liquidity and return, with the amount of liquid assets often set by state insurance regulators. Regulators want to make sure that policyholders will be able to have their claims paid for, and thus require insurers to retain adequate reserves.

Expense --What is an 'Expense'

An expense consists of the economic costs a business incurs through its operations to earn revenue. Businesses are allowed to write off tax-deductible expenses on their income tax returns to lower their taxable income and thus their tax liability. Common business expenses include payments to suppliers, employee wages, factory leases and equipment depreciation, but the Internal Revenue Service has strict rules on which expenses business are allowed to claim as a deduction.

BREAKING DOWN 'Expense'

The term "expense" also operates as a verb, and it means to write off an expense. For example, a freelance writer may expense the cost of buying writing utensils for his business, or the executive may expense the cost of taking his clients to dinner because the group discussed business at the table.

Deductible Business Expenses

According to the IRS, to be deductible, a business expense must be both ordinary and necessary. Ordinary means the expense is common or accepted in that industry, while necessary means the expense is helpful in the pursuit of earning income. Business owners are not allowed to claim their personal, nonbusiness expenses as business deductions.

Recording Expenses

Accountants record expenses through one of two accounting methods: cash basis or accrual basis. Under cash basis accounting, expenses are recorded when they are paid. For example, if a business owner schedules a carpet cleaner to clean the carpets in his office and the cleaner invoices the company for the service, a company using cash basis records the expense when it pays the invoice. Under the accrual method, however, expenses are recorded when they are incurred, and to continue with the above example, the business accountant records the carpet cleaning expense when the company receives the service.

Capital Expenses

The IRS treats capital expenses differently than most other business expenses. While most costs of doing business can be expensed or written off against business income the year they are incurred, capital expenses must be capitalized or written off incrementally.

Capital expenses are typically large expenditures considered investments into a company. They include business startup costs; business assets such as real estate, vehicles, equipment and patents; and improvements such as putting a new HVAC system into a building. Rather than writing off these expenses in the year they are incurred, business owners must write them off slowly over time. The IRS has a schedule that dictates the portion of a capital asset a business may write off each year until the entire expense is claimed. The number of years over which a business writes off a capital expense varies based on the type of asset.

Adjusted Gross Income - AGI

What is 'Adjusted Gross Income - AGI'

Adjusted gross income (AGI) is a measure of income calculated from your gross income and used to determine how much of your income is taxable.

BREAKING DOWN 'Adjusted Gross Income - AGI'

Adjusted gross income (AGI) is a modification of gross income in the United States tax code. Gross income is simply the sum of everything an individual earns in a year. AGI factors a number of deductions from one's gross income to reach the figure for which an individual's income taxes will be calculated, and is generally more useful than gross income for individual tax activities. The deductions which modify gross income to adjusted gross income are all above the line, which means that they are taken into account before tax exemptions for military service, dependent status, etc.

Some of the most prominent deductions made to reach an individual's adjusted gross income include

- Un - reimbursed business expenses

- Medical expenses

- Alimony

- Retirement plan contributions

- Losses incurred from the sale or exchange of property

When calculating individual AGI, begin by tallying your reported income statements for the year in question, while also adding other sources of taxable income: profit on the sale of property, unemployment compensation, pensions, Social Security payments and any other income not reported on your tax returns. From this total of earnings, subtract the applicable deductions to reach your AGI. A complete list of the requirements for possible deductions from gross income can be found in the Internal Revenue Code or on the IRS website. Many of the requirements are very specific, and an individual must look very carefully at the federal tax code to make sure they are eligible for any deductions they are making.

After calculating AGI, the taxpayer can then apply the standard federal tax deductions to reach their taxable income, or if eligible, the taxpayer can itemize their expenses and receive itemized deductions instead, which can be better for the taxpayer in some situations. When working on individual taxes, then, the AGI is an important but intermediate step in determining how much of one's gross income is taxable. Be careful not to confuse AGI with modified adjusted gross income (MAGI), which is used to calculate an individual's deductible amount from an individual retirement account (IRA).

Deductible - A deductible is the amount of money an individual pays for expenses before his insurance plan starts to pay.

The word "deductible" can also work as an adjective to describe the tax-deductible expenses that can deducted from someone's adjusted gross income to reduce his taxable income and his tax liability.

BREAKING DOWN 'Deductible'

To understand insurance deductibles, imagine your deductible is $300, and you incur medical expenses for $2,000. You pay the $300 deductible, also called the out-of-pocket cost, and your insurer pays the remaining $1,700. However, if your entire medical bill is $300, you would pay the entire amount and your insurer would pay nothing.

Insurance deductibles do not just apply to health insurance. Car insurance, homeowners insurance, renters insurance and other types of insurance policies also have deductibles. In the United Kingdom, Australia and some other parts of the world, an insurance deductible is referred to as an excess, but excesses and deductibles function in the same way.

Tax Deductible Expenses

The Internal Revenue Service (IRS) considers a number of expenses to be tax-deductible. To reduce their taxable income, tax filers may deduct eligible healthcare expenses, mortgage interest expenses and some investment-related expenses. However, for those with brokerage accounts, fees such as commissions paid for trades are not deductible.

The IRS divides tax deductible expenses or deductions into two major categories: individual and business.

Deductible Expenses for Individuals

Individuals may claim a standard deduction based on their marital status, filing status and number of children. Set by the IRS and reviewed annually, the standard deduction is subject to change, but as of 2016, it is $6,300 for an individual. If an individual reports $40,000 in taxable income, for example, he can then deduct $6,300 to lower his taxable income to $33,700.

In lieu of the standard deduction, tax filers may opt to itemize their deductions. This means they add together the value of a long list of deductions and then subtract that amount from their earnings to determine their taxable income. Examples of itemized deductions include charitable contributions, mortgage interest, and medical and dental expenses.

Business Deductions

Business deductions work slightly differently from individual deductions. If a small business owner, a self-employed individual, an independent contractor or a corporation is filing taxes, the tax filer reports all of the income the business receives during the tax year. Then, he deducts business expenses from that amount. The difference is the business's taxable income. Deductible business expenses include operating expenses such as payroll, utilities, rent, leases and other costs of running the business. Capital expenses such as buying equipment or real estate for the business are also deductible.

Health Insurance Cut FROM: http://www.investopedia.com/terms/h/healthinsurance.asp?lgl=myfinance-layout-no-ads Date of copy: 6-27-2017

By Investopedia Staff ( Susan is preparing a PDF document - that will list "Investopedia Staff" [ the human beings ] by name ) The following has been edited - by Susan.

What is 'Health Insurance'

Health insurance is a type of insurance coverage that pays for medical and surgical expenses incurred by the insured. Health insurance can reimburse the insured for expenses incurred from illness or injury, or pay the care provider directly. It is often included in employer benefit packages as a means of enticing quality employees. The cost of health insurance premiums is deductible to the payer, and benefits received are tax-free.

BREAKING DOWN 'Health Insurance'

Managed care insurance plans require policy holders to receive care from a network of designated health care providers for the highest level of coverage. If patients seek care outside the network, they must pay a higher percentage of the cost. In some cases, the insurance company may even refuse payment outright for services obtained out of network. Many managed care plans require patients to choose a primary care physician who oversees the patient's care and makes recommendations about treatment. Insurance companies may also deny coverage for services that were obtained without pre - authorization. In addition, insurers may refuse payment for name brand drugs if a generic version or comparable medication is available at a lower cost.

Insurance plans with higher out-of-pocket costs generally have smaller monthly premiums than plans with low deductibles. When shopping for plans, individuals must weigh the benefits of lower monthly costs against the potential risk of large out-of-pocket expenses in the case of a major illness or accident. Health insurance has many cousins, such as disability insurance, critical (catastrophic) illness insurance and long-term care (LTC) insurance.

Affordable Care Act

In 2010, President Barack Obama signed the Patient Protection and Affordable Care Act into law. It prohibits insurance companies from denying coverage to patients with pre-existing conditions, and allows children to remain on their parents' insurance plan until they reach the age of 26. In participating states, the act also expanded Medicaid, a government program that provides medical care for individuals with very low incomes. In addition to these changes, the ACA established the federal Healthcare Marketplace. The marketplace helps individuals and businesses shop for quality insurance plans at affordable rates. Low-income individuals who sign up for insurance through the marketplace may qualify for subsidies to help bring down costs.

Americans are required to carry medical insurance that meets federally designated minimum standards or face a tax penalty. In certain cases, taxpayers may qualify for an exemption from the penalty if they were unable to obtain insurance due to financial hardship or other situations. Two public health insurance plans, Medicare and the Children's Health Insurance Program, target older individuals and children, respectively. Medicare also serves people with certain disabilities. The program is available to anyone age 65 or older. The CHIP plan has income limits and covers babies and children up to the age of 18.

[ END of copy ]

Insurance Coverage

What is 'Insurance Coverage'

Insurance coverage is the amount of risk or liability that is covered for an individual or entity by way of insurance services. Insurance coverage, such as auto insurance, life insurance – or more exotic forms, such as hole-in-one insurance – is issued by an insurer in the event of unforeseen occurrences.

BREAKING DOWN 'Insurance Coverage'

Insurance coverage helps consumers recover financially from unexpected events, such as car accidents or the loss of an income-producing adult supporting a family.

Insurance coverage is often determined by multiple factors. For example, most insurers charge higher premiums for young male drivers, as insurers deem the probability of young men being involved in accident to be higher than say, a middle-aged married man with years of driving experience.

Auto Insurance Coverage

Auto insurance premiums depend on the insured party's driving record. A record free of accidents or serious traffic violations typically results in a lower premium. Drivers with histories of accidents or serious traffic violations may pay higher premiums. Likewise, because mature drivers tend to have fewer accidents than less-experienced drivers, insurers typically charge more for drivers below age 25.

Insurance Premium

By Brent Radcliffe www.investopedia.com/contributors/242/

What is 'Insurance Premium'

An insurance premium is the amount of money that an individual or business must pay for an insurance policy. The insurance premium is considered income by the insurance company once it is earned, and also represents a liability in that the insurer must provide coverage for claims being made against the policy.

BREAKING DOWN 'Insurance Premium'

The amount of insurance premium that is required for insurance coverage depends on a variety of factors. Insurance companies examine the type of coverage, the likelihood of a claim being made, the area where the policyholder lives or operates a business, the behavior of the person or business being covered, and the amount of competition that the insurer faces.

[[ https://en.wikipedia.org/wiki/Actuary ]]

Actuaries employed by an insurance company can determine, for example, the likelihood of a claim being made against a teenage driver living in an urban area compared to one in a suburban area. In general, the greater the risk associated with a policy the more expensive the insurance policy will be.

Policyholders are often given a number of options when it comes to paying an insurance premium. Some insurers allow the policyholder to pay the insurance premium in installments, for example monthly or semi-annual payments, or may require the policyholder to pay the total amount before coverage starts.

Insurance premiums may increase after the policy period ends. The insurer may increase the premium if claims were made during the previous period, if the risk associated with offering a particular type of insurance increases, or if the cost of providing coverage increases.

Insurers use the insurance premium to cover the liabilities associated with the policies that they underwrite, as well as to invest the premium in order to generate higher returns. Insurers will invest the premiums in assets with varying levels of liquidity and return, with the amount of liquid assets often set by state insurance regulators. Regulators want to make sure that policyholders will be able to have their claims paid for, and thus require insurers to retain adequate reserves.

Expense

What is an 'Expense'

An expense consists of the economic costs a business incurs through its operations to earn revenue. Businesses are allowed to write off tax-deductible expenses on their income tax returns to lower their taxable income and thus their tax liability. Common business expenses include payments to suppliers, employee wages, factory leases and equipment depreciation, but the Internal Revenue Service has strict rules on which expenses business are allowed to claim as a deduction.

BREAKING DOWN 'Expense'

The term "expense" also operates as a verb, and it means to write off an expense. For example, a freelance writer may expense the cost of buying writing utensils for his business, or the executive may expense the cost of taking his clients to dinner because the group discussed business at the table.

Deductible Business Expenses

According to the IRS, to be deductible, a business expense must be both ordinary and necessary. Ordinary means the expense is common or accepted in that industry, while necessary means the expense is helpful in the pursuit of earning income. Business owners are not allowed to claim their personal, nonbusiness expenses as business deductions.

Recording Expenses

Accountants record expenses through one of two accounting methods: cash basis or accrual basis. Under cash basis accounting, expenses are recorded when they are paid. For example, if a business owner schedules a carpet cleaner to clean the carpets in his office and the cleaner invoices the company for the service, a company using cash basis records the expense when it pays the invoice. Under the accrual method, however, expenses are recorded when they are incurred, and to continue with the above example, the business accountant records the carpet cleaning expense when the company receives the service.

Capital Expenses

The IRS treats capital expenses differently than most other business expenses. While most costs of doing business can be expensed or written off against business income the year they are incurred, capital expenses must be capitalized or written off incrementally.

Capital expenses are typically large expenditures considered investments into a company. They include business startup costs; business assets such as real estate, vehicles, equipment and patents; and improvements such as putting a new HVAC system into a building. Rather than writing off these expenses in the year they are incurred, business owners must write them off slowly over time. The IRS has a schedule that dictates the portion of a capital asset a business may write off each year until the entire expense is claimed. The number of years over which a business writes off a capital expense varies based on the type of asset.

Adjusted Gross Income - AGI

What is 'Adjusted Gross Income - AGI'

Adjusted gross income (AGI) is a measure of income calculated from your gross income and used to determine how much of your income is taxable.

BREAKING DOWN 'Adjusted Gross Income - AGI'

Adjusted gross income (AGI) is a modification of gross income in the United States tax code. Gross income is simply the sum of everything an individual earns in a year. AGI factors a number of deductions from one's gross income to reach the figure for which an individual's income taxes will be calculated, and is generally more useful than gross income for individual tax activities. The deductions which modify gross income to adjusted gross income are all above the line, which means that they are taken into account before tax exemptions for military service, dependent status, etc.

Some of the most prominent deductions made to reach an individual's adjusted gross income include

- Un - reimbursed business expenses

- Medical expenses

- Alimony

- Retirement plan contributions

- Losses incurred from the sale or exchange of property

When calculating individual AGI, begin by tallying your reported income statements for the year in question, while also adding other sources of taxable income: profit on the sale of property, unemployment compensation, pensions, Social Security payments and any other income not reported on your tax returns. From this total of earnings, subtract the applicable deductions to reach your AGI. A complete list of the requirements for possible deductions from gross income can be found in the Internal Revenue Code or on the IRS website. Many of the requirements are very specific, and an individual must look very carefully at the federal tax code to make sure they are eligible for any deductions they are making.

After calculating AGI, the taxpayer can then apply the standard federal tax deductions to reach their taxable income, or if eligible, the taxpayer can itemize their expenses and receive itemized deductions instead, which can be better for the taxpayer in some situations. When working on individual taxes, then, the AGI is an important but intermediate step in determining how much of one's gross income is taxable. Be careful not to confuse AGI with modified adjusted gross income (MAGI), which is used to calculate an individual's deductible amount from an individual retirement account (IRA).

Deductible

A deductible is the amount of money an individual pays for expenses before his insurance plan starts to pay.

The word "deductible" can also work as an adjective to describe the tax-deductible expenses that can deducted from someone's adjusted gross income to reduce his taxable income and his tax liability.

BREAKING DOWN 'Deductible'

To understand insurance deductibles, imagine your deductible is $300, and you incur medical expenses for $2,000. You pay the $300 deductible, also called the out-of-pocket cost, and your insurer pays the remaining $1,700. However, if your entire medical bill is $300, you would pay the entire amount and your insurer would pay nothing.

Insurance deductibles do not just apply to health insurance. Car insurance, homeowners insurance, renters insurance and other types of insurance policies also have deductibles. In the United Kingdom, Australia and some other parts of the world, an insurance deductible is referred to as an excess, but excesses and deductibles function in the same way.

Tax Deductible Expenses

The Internal Revenue Service (IRS) considers a number of expenses to be tax-deductible. To reduce their taxable income, tax filers may deduct eligible healthcare expenses, mortgage interest expenses and some investment-related expenses. However, for those with brokerage accounts, fees such as commissions paid for trades are not deductible.

The IRS divides tax deductible expenses or deductions into two major categories: individual and business.

Deductible Expenses for Individuals

Individuals may claim a standard deduction based on their marital status, filing status and number of children. Set by the IRS and reviewed annually, the standard deduction is subject to change, but as of 2016, it is $6,300 for an individual. If an individual reports $40,000 in taxable income, for example, he can then deduct $6,300 to lower his taxable income to $33,700.

In lieu of the standard deduction, tax filers may opt to itemize their deductions. This means they add together the value of a long list of deductions and then subtract that amount from their earnings to determine their taxable income. Examples of itemized deductions include charitable contributions, mortgage interest, and medical and dental expenses.

Business Deductions

Business deductions work slightly differently from individual deductions. If a small business owner, a self-employed individual, an independent contractor or a corporation is filing taxes, the tax filer reports all of the income the business receives during the tax year. Then, he deducts business expenses from that amount. The difference is the business's taxable income. Deductible business expenses include operating expenses such as payroll, utilities, rent, leases and other costs of running the business. Capital expenses such as buying equipment or real estate for the business are also deductible.

hhhhhhhhhhhhhhhhh

Senario 1 ( If needed, other scenario illustration examples will be constructed.) - Please, send me a message - by using my form.

|

SCENARIO assumptions: |

( Fred and his wife ) |

|

1) Fred is a 61-year-old male.

2) Fred is a United States citizen.

3) Fred has worked - in the united States [as a "maintenance worker" ] for a "big corporation" -since he was 16-years old. Each year he has paid his personal income taxes due.

4) Fred is married - and, has been for 36+ years - and, he has two grown children. They live in California & Oregon.

5) Fred owns a modest home - in Columbus, Ohio.

6) Fred has a small sum (of cash) saved in the bank.

7) Fred & his wife have planned:

a] to sell their "paid for" home

and b] take a small vacation - after he retires.

8) Fred's wife never did (really) work outside of their home.

9) If they see a place - perhaps a condo - on their planned vacation, they may consider buying it.

10) Fred's wife's health is "good". She wants to "lose a few pounds" - she says. She goes to the YMCA - most days. She walks on the treadmill and does the "zoomba class" sometimes. She cooks breakfast, lunch & dinner - for Fred & herself - most days. She sleeps well. And, Fred finds her usually pleasant to be around.

11) Fred's health is "good" - to outward appearances; however, Fred has noticed some "shortness of breath" - when he exerts himself; and, he gets "sweaty" - unexpectedly - at times. His sleep is disturbed - some nights - by "nightmares".

12) Fred has said nothing about his "small personal issues" to his wife. (He does not want to "worry" her.)

13) Fred has "health insurance" supplied by his employer.

14) Fred wants to take the "early retirement" option - his employer has just offered him.

|

|

|

|

|

( INTAKE Centers - all over the USA ) Hello! How may I help you today? You can: 1) fill out a form; 2) Talk to a computerized assistant; 3) Make an appointment - to talk with a human USA Universal Health Care "intake" professional; or, 4) Please just leave your name - and, a method & we will you.

You came in the door for "something". Let's get to it.

hhh  < Americans >

< Americans >

FlowChart (start) Fred has made the "first STEP" - "intake" (above) NOTE: Graphic (above) - from USA Legal Aid Society

[ DECISION POINT ] : Is "Fred's Issue" an EMERGENCY ? YES-GO A NO-GO B UNKNOWN-GO C

A ( EMERGENCY - YES )

B ( EMERGENCY - NO )

C ( EMERGENCY - UNKNOWN )

Hhhhhhhhhhhhhhhh Kaiser Chart hhhhhhhhhhhhhhhhhh

http://www.kff.org/other/state-indicator/total-population/?currentTimeframe=0&sortModel=%7B%22colId%22:%22Location%22,%22sort%22:%22asc%22%7D

Health Insurance Coverage of the Total Population

NOTES ( by Kaiser)

The majority of our health coverage topics are based on analysis of the Census Bureau’s March Supplement to the Current Population Survey (the CPS Annual Social and Economic Supplement or ASEC) by the Kaiser Commission on Medicaid and the Uninsured. The CPS supplement is the primary source of annual health insurance coverage information in the United States.

In this analysis, income (mostly categorized as a percent of the federal poverty level) is aggregated by Census-defined family units. Analyzing income by family unit captures income available to a group of people who are likely sharing resources. However, family units may not be the appropriate measure for capturing eligibility for health insurance. Eligibility for health insurance is more accurately estimated using “health insurance units,” which may be counted differently for different types of insurance (such as Medicaid or employer coverage).

Data exclude a small number of people with private coverage of an unknown source. Data may not sum to totals due to rounding and the exclusion of these people.

Sources

Kaiser Family Foundation estimates based on the Census Bureau's March 2014, March 2015, and March 2016 Current Population Survey (CPS: Annual Social and Economic Supplements).

Definitions

The ASEC asks respondents about their health insurance coverage throughout the previous calendar year. Respondents may report having more than one type of coverage. In this analysis, individuals are sorted into only one category of insurance coverage using the following hierarchy:

Medicaid: Includes those covered by Medicaid, the Children’s Health Insurance Program (CHIP), and those who have both Medicaid and another type of coverage, such as dual eligibles who are also covered by Medicare.

Medicare: Includes those covered by Medicare, Medicare Advantage, and those who have Medicare and another type of non-Medicaid coverage where Medicare is the primary payer. Excludes those with Medicare Part A coverage only and those covered by Medicare and Medicaid (dual eligibles).

Employer: Includes those covered by employer-sponsored coverage either through their own job or as a dependent in the same household.

Other Public: Includes those covered under the military or Veterans Administration.

Non-Group: Includes individuals and families that purchased or are covered as a dependent by non-group insurance.

Uninsured: Includes those without health insurance and those who have coverage under the Indian Health Service only.

For example, a person having Medicaid coverage in the first half of the year but employer-based coverage in the last months of the year would be categorized as having Medicaid coverage in this analysis.

N/A: Estimates with relative standard errors greater than 30% are not provided.

TAGS

CATEGORIES

hhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhh

Hhhhhhhhhhhhhhhhhhhhhhhhhhhh

Business owners wouldn’t have to insure their workers.

Obamacare required businesses with at least 50 full-time employees to provide its workers with “affordable” insurance – essentially, insurance that cost less than 10 percent of a worker’s household income. Failure to do that currently costs business owners up to $2,260 per employee annually. That tax penalty would disappear under the GOP plan.

So if a person owned a medium-sized business, and didn’t want to provide insurance, she or he could stop.

Here’s the thing: This penalty didn’t affect most “small business” owners.

Of the nearly 30 million businesses in the U.S., 80 percent have no employees – the proprietor is the only one in the shop, according to Small Business Administration data from 2013.

Many medium-sized businesses already provided insurance for their workers before Obamacare took effect. So while some may be glad that they can stop, others are wondering how the GOP health plan will affect insurance rates. Will they be able to afford their employees’ insurance?

Currently, 52 percent of Ohioans get their insurance through an employer, compared with only 5 percent who get private insurance on the Obamacare exchange, according to Kaiser data.

http://www.cincinnati.com/story/news/politics/2017/03/11/5-ways-house-gop-health-plan-would-affect-ohioans/98987230/ <source

http://www.kff.org/other/state-indicator/total-population/?currentTimeframe=0&sortModel=%7B%22colId%22:%22Location%22,%22sort%22:%22asc%22%7D

hhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhh

Hhhhhhhhhhhhhhh Democrat’s platform hhhhhhhhhhhhhhhh

Securing Universal Health Care

Democrats believe that health care is a right, not a privilege, and our health care system should put people before profits.

Thanks to the hard work of President Obama and Democrats in Congress, we took a critically important step toward the goal of universal health care by passing the Affordable Care Act, which has covered 20 million more Americans and ensured millions more will never be denied coverage because of a pre-existing condition.

Democrats will never falter in our generations-long fight to guarantee health care as a fundamental right for every American.

As part of that guarantee, Americans should be able to access public coverage through a public option, and those over 55 should be able to opt in to Medicare.

Democrats will fight any attempts by Republicans in Congress to privatize, voucherize, or “phase out” Medicare as we know it.

We will keep fighting until the ACA’s Medicaid expansion has been adopted in every state.

Nineteen states have not yet expanded Medicaid. This means that millions of low-income Americans still lack health insurance and are not getting the care they need. Additionally, health care providers, clinics, hospitals, and taxpayers are footing a higher bill when people without insurance visit expensive emergency rooms.

Supporting Community Health Centers

We must renew and expand our commitment to Community Health Centers, as well as community mental health centers and family planning centers. These health centers provide critically important, community-based prevention and treatment in underserved communities, prevent unnecessary and expensive trips to emergency rooms, and are essential to the successful implementation of the ACA.

We will fight for a comprehensive system of primary health care, including dental, mental health care, and low-cost prescription drugs by doubling of funding for federally qualified community health centers over the next decade, which currently serve 25 million people.

Democrats also know that one of the key ingredients to the success of these health centers is a well-supported and qualified workforce in community-based settings.

We will fight to train and support this workforce, encourage providers to work with underserved populations through the National Health Service Corps, and create a comprehensive strategy to increase the pool of primary health care professionals.

.

Democrats are committed to investing in the research, development, and innovation that creates lifesaving drugs and lowers overall health costs, but the profiteering of pharmaceutical companies is simply unacceptable.

Hhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhh

> Hello World ! YOU have reached

the personal web site of Susan Marie Cassady-Neuhart.

|

The American Health Act ( AHA) ...

|

|

|

Susan's last UP-DATE: 4-13-2017!

( FSMB ) < Please read this first - to understand "how" the debate is - and, will be (for ever) - informed by "Medical Professionals" - and, their representatives.

The Tenth Amendment to the United States Constitution authorizes states to establish laws and regulations protecting the health, safety and general welfare of their citizens.[6]

Required REFORM of - Medical Liability Insurance market & industry : ( REPORT [pdf] - dated September 12, 2004 ) < Please read report to find the reasons & history - for the current system - of health care - and, its related current pricing - to American consumers.

The American Health Act ( AHA)

( - from "Obama Care" to "Trump Care" )

[ Susan's "idea" text follows ]

The following is Susan's idea ( text only)! This is NOT a bill - or anything official.

YES! - I did try to read the "official" document (links above); However, to "me" - a person with much practical experience ( 30+ years) in reading many complicated, software engineering documents - it ( the official Bill ) is unintelligible. I only know that - it appears ( to "me") - THEY are allotting - more than $15-Billion dollars (in HR 1628) - for something; and, insurance companies, are prominently mentioned ( I feel ) - to receive a large portion of these tax payer funds - with no practical over-sight (detailed) insofar as how they ( the Medical Insurance companies) will further distribute these funds.

The American Health Act ( AHA)

( - from Obama Care to Trump Care )

If agreed to - by Mr. Trump: On May 31, 2017, the American Health Act [ AHA ] shall be introduced by the Donald J. Trump Presidential Administration. The AHA (Act) shall be passed unanimously by the US Congress and receive a Presidential signature - within 2 business days.

President Franklin D. Roosvelt passed such sweeping legislation - during his presidency - And, similar to today - the times and the conditions warranted this.

https://millercenter.org/president/fdroosevelt/domestic-affairs

Key features of the AHA:

- The primary objective of the Act is to protect, promote and restore the physical and mental well-being of citizens of the USA - and, to facilitate reasonable access to health services - through out America - without financial, physical or other barriers. We are all Americans. And, America is a great country. This ACT takes a step to re-claim our international heritage - as a world-leader in all things.

- Another objective of the American Health Act is: continued access to quality health care - without financial or other barriers - for all Americans; as this will be critical to maintaining and improving the health and well-being of all Americans - during any transition from "Obama Care" to "Trump Care".

- To do so, the AHA shall list a set of criteria and conditions (drafted below) that each state - in our Union of 50 States - must follow in order to receive Federal Transfer Payments ( FTPs ). They are - briefly: A) Public Administration - by States, B) Comprehensiveness & Universality, C)Portability, D) Accessibility - and E) Penalties.

- Additional criteria and conditions - extending and altering this AHA - may be introduced into the US Congress (after May 31, 2017) for voting upon by the elected representatives of the American people - as conditions and experience - with the enacted AHA - warrant.

The criteria & conditions - to be met by each state AHA provider are as follows:

A) Public administration

- All AHA medical and health related services and entities must be "administered" and "operated" on a non-profit basis by licensed Medical Professionals - responsible (only) to US State governments and their medical peers.

- The "entities" administered and operated are subject to audits of their records, accounts and financial transactions - by State Government and AHA officials.

- Elimination: All so-called and in reality "Private Insurance Companies & Carriers" shall be eliminated (by this ACT) - until time and experience provides sufficient proof they are necessary - for any practical reason. That is, no one should benefit from the pain and suffering - of an American citizen.

- An ACT of the US Congress - shall be necessary to reverse the previous provision of "elimination".

B) Comprehensiveness & Universality

- There shall be no such entity - in the United States of America - as a "non-insured citizen".

- That is, every United States citizen (born and living) shall be covered and cared for - by reasonably re-numerated Medical Professionals.

- All AHA services shall be provided in excellent "World Class" American Medical Facilities - as required and needed - with no apportionment - related to a State's individual wealth or population.

- The AHA shall cover all health services provided by Medical Professionals in these facilities ( in every state) - including (as needed) psychiatry and dentistry.

- The fees (for AHA services) that may be charged - by Medical Professionals - are as described and stated in the current published USA Medicare program documents (2017).

- If Medical Professionals wish to offer services - that are not currently described by USA Medicare program documents - they may do so; however, those "additional services" shall be provided on a private business basis - and, not covered or administered by the AHA; however, all FDA & USHHS rules and regulations shall apply & be enforced.

- No Medical Professional (employed to provide services - under the AHA) - shall be permitted to simultaneously provide private business services.

- The states are permitted, to offer additional "distinguishing" medical and dental services; however, these "additional services" shall be paid for exclusively by State Transfer Payments (STPs). These STPs shall be administered by the States - and, they may not be made fungible - or, made a part of the AHA ( FTP) funds - in any manner.

C) Portability

- States shall be responsible for their state citizens - who are temporarily in another state - for purposes of work, travel, visiting, etc.

- "Temporary" from more "permanent" relocation status shall be determined - using 90 days as a standard maximum - to make the distinction ( of permanent versus temporary resident) at the program's start.

D) Accessibility

- The AHA shall provide Medical Professionals with the means to provide uniform "reasonable access" to services offered for USA citizens - using all modes of public USA transportation systems ( including trains, plains, buses, taxis, etc.) on uniform terms and conditions.

- Medical Professionals ( after licensure) shall be at liberty to "move about" in America - and, subsequently licensed in other US states.

- All AHA services shall be provided in similar and comparable "World Class" medical facilities - located in every state in America.

- There shall be no "extra-billing" - of any American citizen - for any AHA services rendered.

- Specifically, Medical Professionals in every American location - which, they choose to be located in - shall be re-numerated - at the same AHA rate (per specialty) - adjusted only for provable State "cost-of-living" differences - which, are not "controllable" by other means - such as, medical facility offerings. ( For example, AHA Medical Facilities may provide Medical Professional dormitories, meal rooms, laundries etc.)

- AHA Medical Professional day-to-day travel expenses shall not be reimbursed - through AHA funds. This is to encourage employed AHA Medical Professionals, to live near - where they choose to work - which, will result in improved inner-city areas.

E) Penalties

- The states shall ensure recognition of the Federal Transfer Payments ( FTPs) by publically viewable documents - modeled after modern transaction receipts (on state web sites, etc.)

- States shall provide information to appointed AHA officers as requested. The AHA shall mandate a Director - with staff.

- The size and scope of the AHA "directorate" shall dictate its annual budget.

- The AHA Federally designated Director and their "staff" is entitled to request and receive specific information related to a state's AHA health care services.

- This "information" shall be used in drafting AHA annual reports ( to Congress) - which shall be made available and presented to the American people - regarding how each state has administered its AHA health care services over the previous year.

- This information shall be provided on a timely basis (to the AHA staff) - on a level of detail - as requested by the AHA Federally designated "staff".

- The AHA "Director" shall be appointed by the current President of the United States (during her or his term) - and, no confirmation ( by the US Congress ) is required.

- Each AHA Director ( so named ) - shall offer their resignation - at the end of the "appointing President's" term.

- Each state must "give recognition" to the USA federal government ( as the "ultimate provider" of AHA services ) in public documents and in any advertising or promotional material, relating to Federal AHA health services in the state.

- For non-compliance - with any of the criteria listed above - the federal government ( upon proof) shall withhold all or a part of the Federal Transfer Payment.

- The federal government shall actively enforce these criteria - utilizing all eligible enforcement capabilities of its departments: DOJ, etc.

- Specifically, in recognition of the "status", "privilege" and "honor" that American society confers on licensed Medical Professionals, no Medical Professional shall a) organize "unions" or b) go on "strike" - or, c) take actions to undermine the intent of the AHA - without risk to their State and Federally granted medical license.

[ end of idea ]

|

|

|

|

|

|

|

|

|

|

|

Susan's last UP-DATE: 4-13-2017!

https://berniesanders.com/issues/medicare-for-all

Dear Mr. Sanders, the Health Plan - attributed to you ( above link ) - provides no logical or rational basis - on its face - for discussion. That is, it presents no basis for its estimated costs or the services that it provides. It states no assumptions about physicians (their numbers) - patients (their numbers) - facilities (where services will be provided) or services (what will be done). Yes, I have emailed "your representatives - as suggested - at that same web site. At this writing, I have not heard from you - or them. I look forward to moving ahead - together - and, informing each other - as we proceed. - Susan

Your representatives: Friends of Bernie Sanders

PO BOX 391

Burlington, VT 05402

email us at help@ourrevolution.com and < done !

My last UP-DATE: 11-21-2018!

( FSMB ) < Please read this first - to understand how the debate is - and, will be - informed by "Medical Professionals".

Required REFORM of - Medical Liability Lnsurance market & industry

( REPORT [pdf] - dated September 12, 2004 ) < read this to find the reasons & history...

The American Health Act ( AHA) ( - from "Obama Care" to "Trump Care" ) [ Susan's "idea" text is below ]

After your REVIEW ( of my AHA "draft" idea presented below ) - please "me" - with your COMMENTS. If you are basically polite - and, I can understand the good reasons - for your comments AND suggestions - I may incorporate your comments. I will credit you - if I incorporate your comments/suggestions AND you give me your written permission (in your submission) - to identify you. Please provide a means for me to confirm - that your "identifying information" is real. Please be creative and thoughtful. For example, if you claim that you are (the) Mr. Donald Trump - or (the) Congressman Joe Kennedy - then, I must be able to verify that this is true. -- In fact, I would be honored to hear from all of you. In Columbus, Ohio - public schools ( 1960 - 1972 ) we were taught - that everyone's opinion matters. This was reinforced during my time at the University of Wisconsin ( UWGB ).

NOTE: Following is an "idea" presented by ( "me" ) Susan Marie CASSADY-Neuhart ( to Mr. Trump - initially - on 4-4, 2017). However, our US Congress is working on real ( and official ) legislation - related to this same subject. That is "Trump CARE" is not dead - and, the odds are - that the US 115th Congress will enact "something". Please become informed - and participate. https://rules.house.gov/ -- https://rules.house.gov/bill/115/hr-1628 (BILL Summary)

Your representatives (DEMs & REPs) they ( "they" ) really do want your input - on this subject. In fact, each one of them has a web site - and, you can Contact them - by various means [ telephone, USPS, contact Forms... ] - to let them know - what you think. They are looking for good ideas. Please "speak up". The US Congress House RULEs Committee member's contact information is shown below. If your state is not on the list - then, write to your Congressional Representative (any way).

For example - my current Congressional Representative is: Congressman Mr. Mike Turner [OH 10]. Mike is not on any Health-related committee (yet). And, ( he knows ) that I am a passionate Democrat. Mike is a Republican. But, even though our fundamental philosophies are different, he is listening. He is an American. And, this is what Americans "do". That is, we listen to each other. And, one day - he will vote. Until he "votes" - it is my job - as an American - to try to persuade him - to try to persuade other US Congressional Representatives. Mike's - Health CARE - related - legislation - currently pending: ( text of Mike's announcement ) H.R. 285 H.R. 286 H.R. 287

|

How Federal laws are made in the USA

( the process )

|

The following is an "idea" [ for comment ] and "proposed" ONLY ( PDF doc 3 pages) Public comments are being incorporated now. Please "me" - a United States citizen.

- PLEASE, also review the official bill ( H.R. 1628 - American Health Care Act of 2017 -- pdf ) as it has been published by the US House of Representatives Clerk's Office. Please be aware this official "bill" is still - in progress - to become US Law. (BILL Summary) Visit the Rules Committee web site - and participate. https://rules.house.gov/

|

The US House of Representatives “Committee on Rules” ...

https://www.congress.gov

( search all active legislation

in the US Congress )

|

|

.Every Federal Law - in the USA - begins in the U.S. House of Representatives. (State laws are created by state legislatures. And, there are "local" government laws also.)

Federal laws super-cede all State laws; which, super-cede all local laws.

All Federal laws - in the United States - originate as written documents called "bills" .

"Bills" - and all USA law - begin as "ideas".

These ideas may come from a elected representative or from a citizen.

Citizens ( who have ideas for laws) can contact their Congressional Representatives to discuss their ideas - for a law.

Every US Citizen has 4 elected representatives. That is, 2 Senators, one US House Congressional district person - and, the US President. Your residential zip-code defines who your USA Congressional representatives are. The President - of the USA - is a representative of all American citizens.

If your Representatives [ or, any US HOUSE Representative agrees - with an idea - you propose ( to them) ], they may draft - your idea - into a written " bill ".

http://www.house.gov/representatives

US citizens must use only legal means - to persuade and convince their representatives to propose a bill. - LEGAL means of persuasion: ( UWGB )

A Bill Is formally "proposed" ( by a US House Representative) by a writing. Thus, many citizens draft the idea - for a bill (their "idea" ) - in writing. This beginning - in writing - is then ( most often ) changed & perfected ( by the citizen's representatives) - because, each bill must be "sponsored". That is, when a citizen's Representative has written a bill - that the Representative is pleased with, the Representative seeks sponsors - who will also support the bill. This is call " politics ".

Typically, the citizen's Representative talks with other Representatives about the bill ( as proposed ) in hopes of getting their support for it. US citizens often vote for - and select - their representatives - based upon how well - they are perceived - to perform "politic-ing" .

Once a bill has at least one sponsor - and, it is in written form -it is ready to be "introduced".

In the U.S. House of Representatives, a bill is "introduced" when it is placed into the "hopper" — a special box on the side of the US House of Representative clerk’s desk.

"hopper"

Only "elected" Representatives can introduce bills in the U.S. House of Representatives.

When a bill is introduced in the U.S. House of Representatives, a " bill clerk " assigns it a number that begins with H.R.

A "reading clerk" then (literally) reads (aloud) the bill (as placed into the hopper) to all the Representatives (present), and the Speaker of the House sends the bill to one of the House standing committees.

When the bill reaches it "assigned committee" the committe's members "review", "research", and "revise" the inially proposed bill and vote For or Against sending the bill back to the House floor.

If the committee members would like more information before deciding if the bill should be sent to the House floor, the bill is sent to a "subcommittee".

While in subcommittee, the bill is closely examined - and expert opinions are gathered - before it is sent back to the committee for approval.

When the committee has approved a bill, it is sent — or reported — to the House floor.

Once "reported", a bill is ready to be debated by the U.S. House of Representatives.

During the period of debate - all current US Congress Representatives (civilly) discuss the bill and explain - in US Communications mediums - why they agree or disagree with the bill - as presented.

Then, a "reading clerk" reads the bill ( again) - this time, section-by-section and the US Congress Representatives (again) may recommend changes - in writing.

When all changes have been made, the "final" bill is ready to be voted on - by US Congress House Representatives.

The number of voting representatives in the House is fixed ( by law) at no more than 435, proportionally representing the population of the 50 United States. Currently, there are five delegates representing the District of Columbia, the Virgin Islands, Guam, American Samoa, and the Commonwealth of the Northern Mariana Islands. A resident commissioner represents Puerto Rico.

There are three methods for voting on a bill in the U.S. House of Representatives:

1) Viva Voce (voice vote): The Speaker of the House asks the Representatives who support the bill to say “aye” and those that oppose it say “no". This "voice vote" may be recorded.

2) Division: The Speaker of the House asks those Representatives who support the bill to stand up and be counted, and then those who oppose the bill to stand up and be counted. This "divional vote" may be recorded - by photgraphs or cameras.

3) Recorded: Representatives record their vote using the electronic voting system. This "Recorded vote" is reported in all USA mediums of Communication.

Representatives may vote -yes, -no, or -present (if they don’t want to vote on the bill).

If a majority of the US Representatives say or select yes, the bill ( as presented - in its "final" form) passes in the U.S. House of Representatives -

And, it is then "certified" by the Clerk of the House [ in its final form ] and it is "delivered" to the U.S. Senate.

This phase of USA "law-making" is known as "referred to the Senate".

Each "referred bill" is (then) discussed in a Senate committee and then "reported" to the Senate floor to be voted on - by US Senators.

There are 100 US Senators. That is, each state has 2 Senators - per state.

Senators also may vote 3 ways. "Roll call", "Voice Vote" or "standing" Those who support the bill under consideration say “yea, yeah - or yes” - and those who oppose it say “nay - or no”; depending upon where they learned to speak English.

If a majority of the Senators "vote in the affirmative" the bill "passes" in the U.S. Senate - and, the Bill Is (then) Sent to the US President.

A bill that does not pass the senate "dies".

When a bill reaches the President's desk, he has three choices: He can:

1) Sign and pass the bill—the bill becomes a law.

2) Refuse to sign, or veto, the bill—the bill is "sent back" to the U.S. House of Representatives, along with the President’s reasons for the veto.

If the U.S. House of Representatives and the U.S. Senate still believe the bill should become a law, they can hold another vote on the bill.

If two-thirds of the House of Representatives and Senators support the bill, the President’s veto is overridden and the bill becomes a law - even if the US President has "vetoed" - or, refused to sign the law.

3) Or, the US President may do nothing; This is called a "pocket veto"; however, if Congress is in session, the bill automatically becomes law 10 days - after being placed upon the President's desk.

If Congress is not in session, the bill does not become a law.

If a bill has passed in both the U.S. House of Representatives and the U.S. Senate and has been approved by the President, or if a presidential veto has been overridden, the bill becomes a "law" and, it is codified and enforced by the Federal, State and local governments - in all of the USA.

This presentation of "How Federal laws are made in the USA" was informed by information published by the Office of the Clerk, U.S. Capitol, Room H154 - Washington, DC 20515-6601 : telephone (202) 225-7000

http://www.house.gov/representatives

http://clerk.house.gov/about/index.aspx

https://www.senate.gov/general/Features/votes.htm

|

The following is Susan's idea (only)! This is NOT a bill - or anything official. YES! - I did try to read the "official" document (links above); However, to "me" - a person with much experience in reading many complicated, software engineering documents - it ( the official Bill ) is unintelligible. I only know that - it appears - THEY are allotting - more than $15-Billion dollars (in HR 1628) - for something; and, insurance companies, are prominently mentioned ( I feel ) - to receive a large portion of these tax payer funds - with no over-sight insofar as how they ( the Medical Insurance companies) further distribute these funds.

The American Health Act ( AHA)

( - from Obama Care to Trump Care )

If agreed to - by Mr. Trump: On May 31, 2017, the American Health Act [ AHA ] shall be introduced by the Donald J. Trump Presidential Administration. The AHA (Act) shall be passed unanimously by the US Congress and receive a Presidential signature - within 2 business days.

President Franklin D. Roosvelt passed such sweeping legislation - during his presidency - And, similar to today - the times and the conditions warranted this.

https://millercenter.org/president/fdroosevelt/domestic-affairs

Key features of the AHA:

- The primary objective of the Act is to protect, promote and restore the physical and mental well-being of citizens of the USA - and, to facilitate reasonable access to health services - through out America - without financial, physical or other barriers. We are all Americans. And, America is a great country. This ACT takes a step to re-claim our international heritage - as a world-leader in all things.

- Another objective of the American Health Act is: continued access to quality health care - without financial or other barriers - for all Americans; as this will be critical to maintaining and improving the health and well-being of all Americans - during any transition from "Obama Care" to "Trump Care".

- To do so, the AHA shall list a set of criteria and conditions (drafted below) that each state - in our Union of 50 States - must follow in order to receive Federal Transfer Payments ( FTPs ). They are - briefly: A) Public Administration - by States, B) Comprehensiveness & Universality, C)Portability, D) Accessibility - and E) Penalties.

- Additional criteria and conditions - extending and altering this AHA - may be introduced into the US Congress (after May 31, 2017) for voting upon by the elected representatives of the American people - as conditions and experience - with the enacted AHA - warrant.

The criteria & conditions - to be met by each state AHA provider are as follows:

A) Public administration